By Mike Krueger*

The U.S. government shutdown extended into mid-November before finally being resolved. The USDA was mostly silent during the 40+ day closure. There were no weekly export sales reports or daily export sales announcements. Nor were there any weekly crop progress reports, so there was no measure of harvest progress or winter wheat planting progress.

More importantly, the October crop production estimates and WASDE (supply/demand) reports were also canceled.

The grain and oilseed markets were, in essence, flying blind during this period.

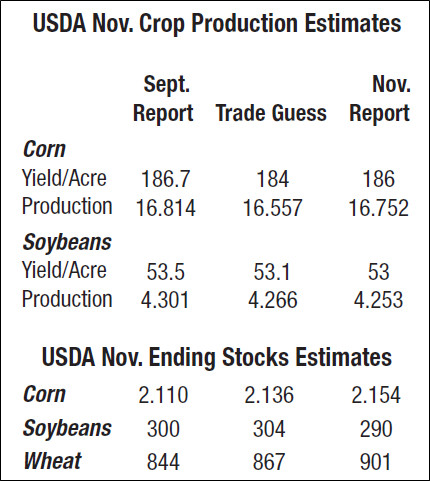

The USDA released their November series of reports on November 14. The tables below show the important numbers, crop production and ending stocks estimates from the November reports.

There was nothing bullish about the November USDA reports. Nearly every number they released was bigger than the average trade guess. The same was true from a world perspective. The USDA raised their wheat production estimates in every major wheat producing country, including Canada, Australia, Argentina and Russia. They made no changes to their corn and soybean production estimates for Brazil and Argentina.

U.S. wheat ending stocks increased by 34 million bushels. Corn ending supplies were increased 44 million bushels. Soybean ending supplies were cut by five million bushels. Smaller soybean production was offset by a 50-million bushel reduction in the export forecast.

The level of U.S. wheat, corn and soybean exports will be the next important market factor. The last complete export sales report was released at the end of September. At that time, total soybean sales and shipments were running about seven MMTs (260 million bushels) below last year at the same time. (Keep in mind the corn and soybean marketing years started September 1.)

The obvious reason for the steep decline from last year is the absence of China as a buyer. There are currently zero soybean sales to China registered with the USDA.

The Trump/Xi meeting in South Korea at the end of October reportedly resulted in China agreeing to purchase 12 MMTs of U.S. soybeans in the following three months, followed by 25 MMTs per year for the next three years. It will be difficult, if not impossible, to accomplish the 12 MMT sales goal with none on the books yet. China has been a very aggressive buyer of soybeans from Brazil over the past several months. Some analysts think China is “full” of soybeans.

The corn export sales report reflected the fast pace of U.S. corn sales since last summer. Corn export sales were about 11 MMTs (440 million bushels) ahead of last year’s pace. Mexico is the biggest buyer. China has been absent.

Wheat export sales were about three MMTs (110 million bushels) ahead of last year’s pace. The wheat marketing year started June 1. China does not show up as a buyer despite recent rumors of sales.

The markets will be watching the next “catch-up” export sales report carefully to see where sales stand following the government shutdown — especially soybean sales to China.

The November USDA WASDE report pegged 2026 Brazil soybean production at 175 MMTs. Planted acres there are projected to be up about 3.5% from last year. Weather, however, has been less than ideal in some key production regions. That has analysts starting to back off on record production expectations.

USDA did not release a sunflower production estimate in November. They typically do that in the October reports. It is now uncertain when or if they will release a production estimate. It might not happen until the “final” estimates are released in January.

The high-oleic sunflower market has been very firm, with prices nearly $2.00/cwt higher than year-ago levels. New-crop (2026) contract prices are also higher than last year. The two-for-one premium for each percent of oil content above 40% is also still in place.

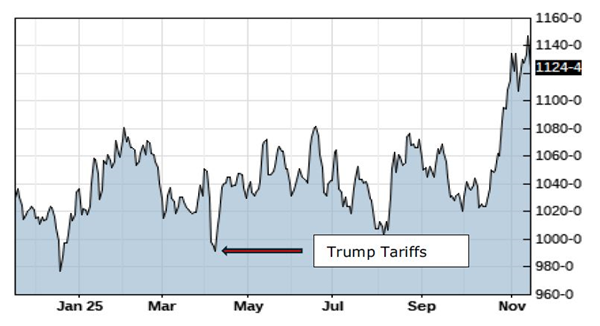

Despite the bearish soybean supply news from Brazil (record crops and exports) and the lack of U.S. sales to China, soybean futures have rallied to their highest level in the last 18 months. U.S. soybean crush continues to set new records every month. Soybean meal demand has also been much better than expected. The question is whether commodity prices can sustain current levels amid forecasts for another great year in world crop production. Like last year, the world soybean situation is a tale of two countries: big supplies in Brazil coupled with tight supplies in the U.S.

The markets must also continue to deal with unpredictable outside market factors. The U.S. Supreme Court is considering the legality of the Trump tariffs. This decision could play a major role in U.S. competitiveness going forward.

The chart below is the one-year January soybean futures market as of November 14, the day the November WASDE report was released.

* Mike Krueger founded The Money Farm, and is now a senior analyst with World Perspectives, a Washington, D.C.-based consulting company. While the information in this article is believed to be reliable, marketing involves risk, and the author and The Sunflower assume no responsibility for its use.