Increases Reference Prices & Expands Farm Program Support

By Tom Hance*

In early July, Congress passed and President Trump signed into law the “One Big Beautiful Bill Act” (OBBBA). The package was passed by Congress under the budget reconciliation process which is not subject to the filibuster in the Senate and therefore can be enacted with a simple majority vote, though it must adhere to rules that require all provisions to have a direct budget impact.

The bill passed the Senate by a vote of 50-50 with Vice President Vance casting the tie-breaking vote, and the final vote in the House of Representatives was 218-214.

The package includes a broad range of provisions including tax, entitlement program changes, and major farm bill components. The Congressional Budget Office (CBO) estimates the bill will result in a net budget cost of $3.4 trillion over the 2025-2034 period, relative to CBO’s January 2025 baseline. The net cost results from a decrease in direct spending (via entitlement program changes) of $1.1 trillion and a decrease in revenues (tax changes) of $4.5 trillion.

The farm bill provisions account for an estimated increase of $66 billion in spending above the current baseline. The increases to Reference Prices (combined with the increase in base acres) makes up $50.4 billion of that farm bill spending over 10 years while the crop insurance premium assistance enhancements cost $3.1 billion.

There is a lot to like for farmers in the OBBBA. Highlights of the final bill include:

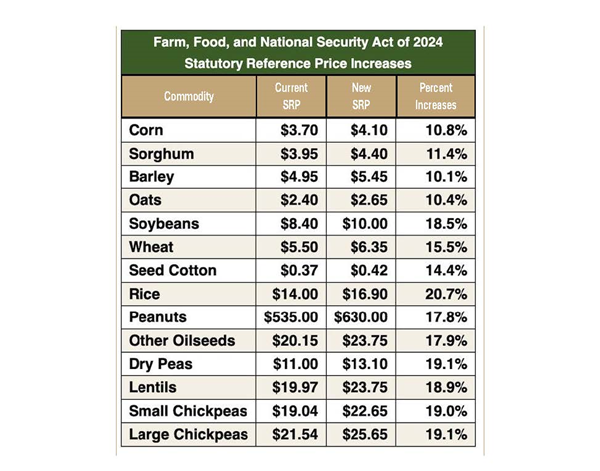

Reference Prices — The Reference Price under the Price Loss Coverage (PLC) program are increased, with the “Other Oilseeds” category, which includes sunflower, moving from the current $20.15 per pound to $23.75. The bill also bolsters the Effective Reference Price escalator provisions and incorporates an annual automatic 0.5% increase in Reference Prices beginning in 2031. The chart below shows the Reference Price changes for all of the covered commodities and reflects how well sunflower fared.

ARC — The Agriculture Risk Coverage (ARC) program is enhanced with the ARC guarantee increased from 86 to 90% of the benchmark revenue and the payment band to 12% for crop years 2025 through 2031.

Notably, the bill makes the new ARC and PLC provisions available for 2025 crop year. Regardless of what a grower signed up for earlier this year, they would get the higher of ARC or PLC assistance for 2025. This would be for 2025 only, and annual program elections would resume in 2026 and after.

Base Acres — One of the most significant changes for many farmers will be the increase in base acreage authorized in the bill. Farmers will have the opportunity to voluntarily add base acres using the average of their plantings from 2019- 2023. It will be a one-time voluntary allocation of 30 million new base acres for farm owners who currently do not have base or whose average planted acres and acres prevented from being planted exceed the current base acres on the farm. If nationwide applications and eligibility exceeds 30 million acres, USDA will pro-rate the acres among all growers.

Marketing Loan Rates — Increases Marketing Assistance Loan rates for all loan commodities by 10%.

Payment Limits — The payment limitations for Title I payments are increased from $125,000 to $155,000, adjusted annually to account for inflation.

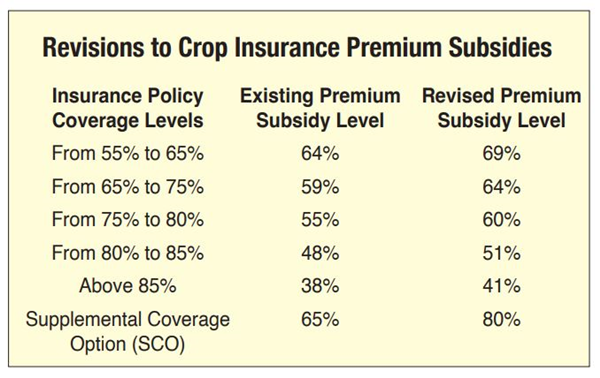

Crop Insurance — The premium assistance levels for individual coverage are increased by 3-5% and the Supplemental Coverage Option (SCO) coverage level is increased to 90%. Also, the premium support is increased from 65 to 80%.

MAP/FMD — Funding is provided equivalent to a doubling of the current Market Access Program and Foreign Market Development (MAP/FMD).

Tax Provisions — Beyond agriculture-specific provisions, the OBBBA includes a wide array of tax reforms benefitting farmers and small businesses. Key items include the permanent extension of the 20% Section 199A business income deduction for small businesses, permanent reinstatement of 100% bonus depreciation, and increased Section 179 expensing allowances of up to $2.5 million for equipment and software. The bill also maintains stepped-up basis, current capital gains rates, and like-kind exchanges. The estate tax exemption would rise to $15 million per individual and $30 million per couple, adjusted for inflation and made permanent.

Now that the bill has been enacted, attention turns to USDA for implementation. Most of the provisions should be pretty straight-forward for USDA to implement. Items that might require some attention and decisions by USDA would include calculating the ARC/PLC “better of” option for growers in 2025 and construction of the sign-up and application for the base acre increase.

Regardless of the details of the implementation, the “One Big, Beautiful Bill” provides a lot of beneficial provisions for farmers.

* Tom Hance is with Gordley Associates, Washington representatives for the National Sunflower Association.