By Mike Krueger*

It has been one of the best growing seasons across North America in a very long time. This has been especially the case across the U.S. Corn Belt. Moisture has been adequate to plentiful nearly everywhere, and there have been only brief periods of high temperatures.

The corn crop sailed through the pollination period with few concerns. There was chatter that nighttime temperatures were too warm in some areas, but that talk didn’t gain any traction.

August is the critical month for soybean yield development and August weather forecasts as of this writing suggest no adverse weather.

U.S. sunflower acres are significantly larger than last year. Oil sunflower planted acres are projected to increase from 594,000 in 2024 to 881,000. Nonoil acres are down just slightly. The USDA weekly crop progress reports do not include sunflower ratings, but corn and soybean ratings in North and South Dakota have been 65% to 70% in the good to excellent categories. The sunflower crop should be in very good condition as well.

U.S. wheat production will be slightly below last year. The spring wheat crop is projected to be smaller, and the “normal” summer weather should mean lower protein levels as well.

There were real concerns about dry conditions across much of western Canada early in the season, but cooler weather and improved rainfall alleviated those concerns. Estimates for Canadian canola production now exceed 20 million metric tons, compared to 19 MMTs last year. Canada’s wheat crop is projected to be slightly larger than last year.

World wheat production will be larger than last year, with EU soft wheat production now forecast to increase by 15% despite a hot and dry summer across northern France. India’s wheat crop is also big.

South America’s corn and soybean crops were big as well. Brazil’s soybean crop will set a record at 175 MMTs. Their corn crop is also big. U.S. soybeans and corn will face very tough competition in export markets.

It is no wonder that prices for wheat, corn and soybeans are all at or near their lows for this season. The speculative funds have held large short positions in every market except soybean oil all summer. There has never been a real or sustained threat to crop yields virtually any place around the world. It has been a very bearish season from a production standpoint, and there is nothing to suggest that outlook will change anytime soon. Prices do tend to establish lows early in years like this.

It has been a turbulent spring and summer in geo-politics as well. U.S. financial markets collapsed when President Trump announced major tariffs in early April, only to set new highs mid-summer when new trade deals started to get consummated with a number of significant trading partners. A deal with China, critical to U.S. soybean exports, continues to be elusive. There also are no deals with Mexico, the largest buyer of U.S. wheat and corn, or Canada.

The Russia-Ukraine war also continues to rage on with no progress in peace talks. The situation in the Middle East also remains unresolved.

U.S. corn ending supplies are projected to increase in the next marketing year that starts September 1. Soybean ending supplies are projected to decline slightly.

The USDA’s August WASDE and crop production estimates reflected a huge increase in the corn yield to a new record 188.8 bu/ac. That increased the production estimate by 545 million bushels. Ending stocks were raised from 1.66 billion bushels in the July forecast to 2.117 billion bushels in the August forecast.

The August soybean numbers were bullish. The soybean yield will also be a new record, but harvested acres were again reduced and are now projected to be down a whopping six million acres from last year. Ending supplies were reduced from 310 million bushels in July to 290 million bushels in August.

Smaller soybean exports will be offset by another year of record soybean processing. Soybean oil is the driver, with soy oil consumption in biofuels projected to set a record at 15.5 billion pounds in the 2025/26 year. (It was 13.9 billion pounds this year and 12.25 billion the year before that.) The EPA announced new biofuels targets in June that were much larger than expected.

There will not be any sunflower production estimates released until October.

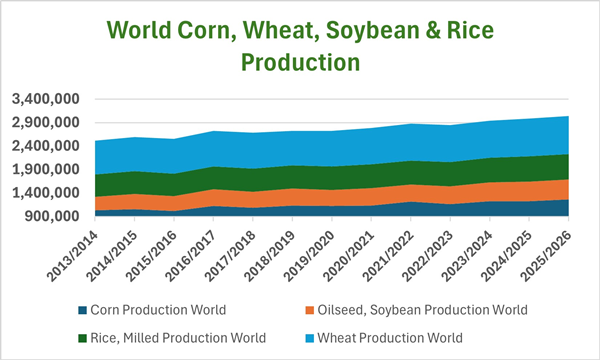

The long and short of it is that world crop production will set another record in 2025. This is despite all the fears that climate change, global warming, etc., would lead to widespread crop failures and increased threat of famine. It simply hasn’t happened yet. World demand will also be at record levels, but supplies will still build. Producers will be faced with a period of low prices until northern hemisphere crops are harvested and find cover. Then it will be up to demand to drag prices higher.

The above chart shows world production of corn, wheat, soybeans and rice over the past 12 years. It is really quite amazing — the result of more planted acres, better farming practices in lesser- developed regions, and, of course, good weather.

* Mike Krueger founded The Money Farm, and is now a senior analyst with World Perspectives, a Washington, D.C.-based consulting company. While the information in this article is believed to be reliable, marketing involves risk, and the author and The Sunflower assume no responsibility for its use.