Article Archives

Expected Hike in Biodiesel Big Boost for Veg Oils

Saturday, January 1, 2022

filed under: Marketing/Risk Management

By Mike Krueger*

There are significant changes on the horizon for world vegetable oil markets in the near future. World vegetable oils include soybean oil, palm oil, canola/rapeseed oil, sunflower oil and a number of “lesser” oils.

The primary driver is the expected sharp increase in the demand for vegetable oil in biodiesel production, both in the U.S. and globally. There are three primary drivers of this expected big change in demand:

• Energy costs are going higher, and it makes economic sense to blend vegetable oils, mostly soybean oil, to make biodiesel.

• The letters ESG. ESG stands for Environmental and Social Governance — the Green movement. Many of the biggest companies are now demanding their suppliers get more environmentally friendly. Many states and governments are demanding lower carbon fuel emissions. Biofuels help meet these goals.

• The fleets of trucks, etc., that consume diesel fuel are projected to double in the next 20 years as the economy and the population grows.

• Rail and marine use of biodiesel will also start to expand.

Soybean oil is, of course, a byproduct of crushing soybeans. Soybeans have been crushed/processed for the high protein soybean meal that goes into animal feed. About 20% of a soybean is oil and the balance is meal. Palm yields between 65% and 70% oil. Approximately 85% of the world’s palm oil comes from Malaysia and Indonesia. Sunflower and canola yield (about) 45% to 50% oil.

Soybean oil has almost always been a problem to get rid of. It has been the weak side of the soybean crush equation virtually every year. A decade or more ago, it looked like a federal biodiesel mandate (including subsidies, tax credits, etc.) was going to quickly absorb all the surplus soybean oil, but that never happened. Politicians decided biofuels (mostly ethanol) weren’t as great a deal as expected because we discovered an oil surplus and gas prices weakened. Biodiesel was pushed to the sidelines. A chart of biodiesel production clearly shows big dips in production during years the U.S. Congress failed to re-authorize blenders tax credits for biodiesel.

That has all changed — and, this change continues to happen quickly.

There are now biodiesel mandates in more than 70 countries.

Low Carbon Fuel Standards (LCFS) in the U.S. have resulted in a rapid expansion of renewable diesel production, and you need vegetable oil to make that happen. Some analysts believe we could see biodiesel production increase by seven to eight times in the next five years. It’s interesting that the USDA’s latest 10-year baseline projections do not reflect growth anywhere near this magnitude. The latest WASDE (supply/demand) does show biodiesel consumption of soybean oil rising from 8.8 billion pounds in the last marketing year to 11 billion pounds in this marketing year. That’s a 25% increase in one year.

In the last year alone more than $1 billion in new or expanded soybean processing plants in the U.S. and nearly C$1.4 billion dollars in canola processing expansion in Canada have been announced. These expansions are predicated on this expected huge growth in the biodiesel industry in North America.

ADM recently started construction on a new soybean processing plant near Jamestown, N.D. There is chatter of another group also planning a new soybean plant in North Dakota.

Bartlett has announced they will build a new soybean plant in Kansas. Cargill is going to spend close to $500 million to update and expand existing soybean processing plants.

The new and expanded soybean processing plants will consume as much as 175 to 200 million bushels of soybeans in the U.S. and as much as 5.0 to 6.0 million metric tons of new canola/rapeseed processing in Canada.

Canada currently produces 18 to 20 MMTs of canola each year. This new processing capacity will require canola production to expand by 20% to 25%. Those acres must come from other crops in western Canada, like spring wheat, durum, pulse crops, etc. That will be a huge task. Demand for these other crops is also getting bigger.

The new soybean plant now under construction in North Dakota (the first plant dedicated to soybeans in this state) will consume 50 million bushels of soybeans annually. North Dakota produced 188 million bushels of soybeans in 2021, so this single new processing plant will consume about 25% of North Dakota’s soybean production. A second plant would cut North Dakota’s exportable surplus of soybeans in half. That exportable surplus has historically gone to supply export demand from the PNW (Pacific Northwest).

The steep increase in demand for vegetable oils in biofuels should have a bigger impact on the high-oil crops like sunflower and canola simply because the oil yield is so much greater than from a soybean. Another reason is that sunflower and canola are primarily grown in the Northern Plains and western Canada where several crops compete for the same acres.

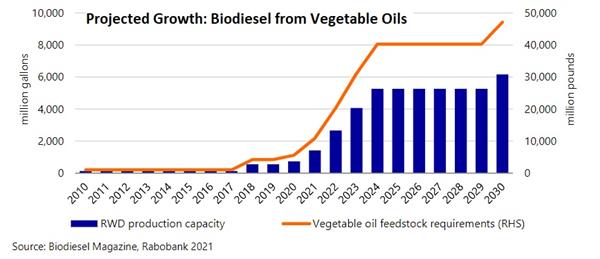

The chart below, courtesy of Rabo Bank and Biodiesel Magazine, clearly shows why the big expansion in processing plants is happening:

The sharp increase in demand (U.S. and world) demand for vegetable oil in biofuels will strengthen oilseed crushing margins. Some analysts estimate it will take an increase of at least three million acres of soybeans in the U.S. in the next two to three years to supply the new and expanded crushing plants. It will be a struggle for Canada to find enough canola acres to supply the new plants. Canola will have to buy acres from other crops.

Oil sunflower prices should benefit from the expected higher levels of vegetable oil prices. Interior basis levels for soybeans and canola will have to shift to a higher level to satisfy this new demand plus the competition for soybeans in the export market.

* Mike Krueger founded The Money Farm, and is now a senior analyst with World Perspectives, a Washington, D.C.-based consulting company. While the information in this article is believed to be reliable, marketing involves risk, and the author and The Sunflower assume no responsibility for its use.